starting a

savings plan

Once you’ve got your emergency funds in place, you can start to think about the various options around short term savings plans.

This can be for things you’d like to be able to afford within the next 5 years.

Scroll down to read our guide, watch our videos, listen to our audio files, view follow up resources, book onto our next live online masterclass, watch a recording and check your employee benefits.

Then share your feedback with us and you could win a wellbeing spa day for two!

THE finwell guide

View our FinWELL Guide on Savings Plans…

videos & podcasts

Watch a video or listen to audio content…

fOLLOW UP RESOURCES

View next steps and follow up resources…

EMPLOYEE BENEFITS

Check your existing employee benefits…

✅ Step 1: Define Your Savings Goals

Decide what you're saving for, how much you’ll need, and your timeline.

🎯 Examples:

Emergency Fund (3–6 months of expenses)

Holiday or Wedding

House Deposit

Retirement

✅Step 2: Know Your Budget

Track income and expenses. Consider apps like YNAB, Mint, or a simple spreadsheet.

Look for areas to cut back and reallocate to savings.

✅Step 3: Decide How Much to Save

Use the 50/30/20 Rule as a starting point:

50% Needs

30% Wants

20% Savings/Extra Debt Repayment

Or start smaller with 10% of your income if you’re just beginning.

✅Step 4: Choose the Right Savings Account

Pick an account based on:

How soon you’ll need the money

Interest rates

Access restrictions

✅Step 5: Automate Your Savings

Set up an automatic transfer the day after payday.

This makes saving effortless and consistent.

✅Step 6: Track & Review Monthly

Check your progress monthly and adjust if needed.

Celebrate small wins!

💡 TOP TIPS FOR SUCCESSFUL SAVING

Name your savings goals in your banking app (e.g., “Paris Trip”).

Open multiple accounts for different goals if helpful.

Out of sight = out of mind – keep savings in a different bank.

Use round-up features (e.g., bank apps that round purchases and save the change).

Review interest rates yearly and move your money if a better rate appears.

SUMMARY

1. Define Goals - Short-, mid-, and long-term goals

2. Budget - Know your spending/saving potential

3. Choose Amount - Use % of income or fixed targets

4. Pick Account - Based on your goal, timeline, potential need to access and also consider interest rates options

5. Automate - Set and forget transfers

6. Monitor - Monthly review and adjust

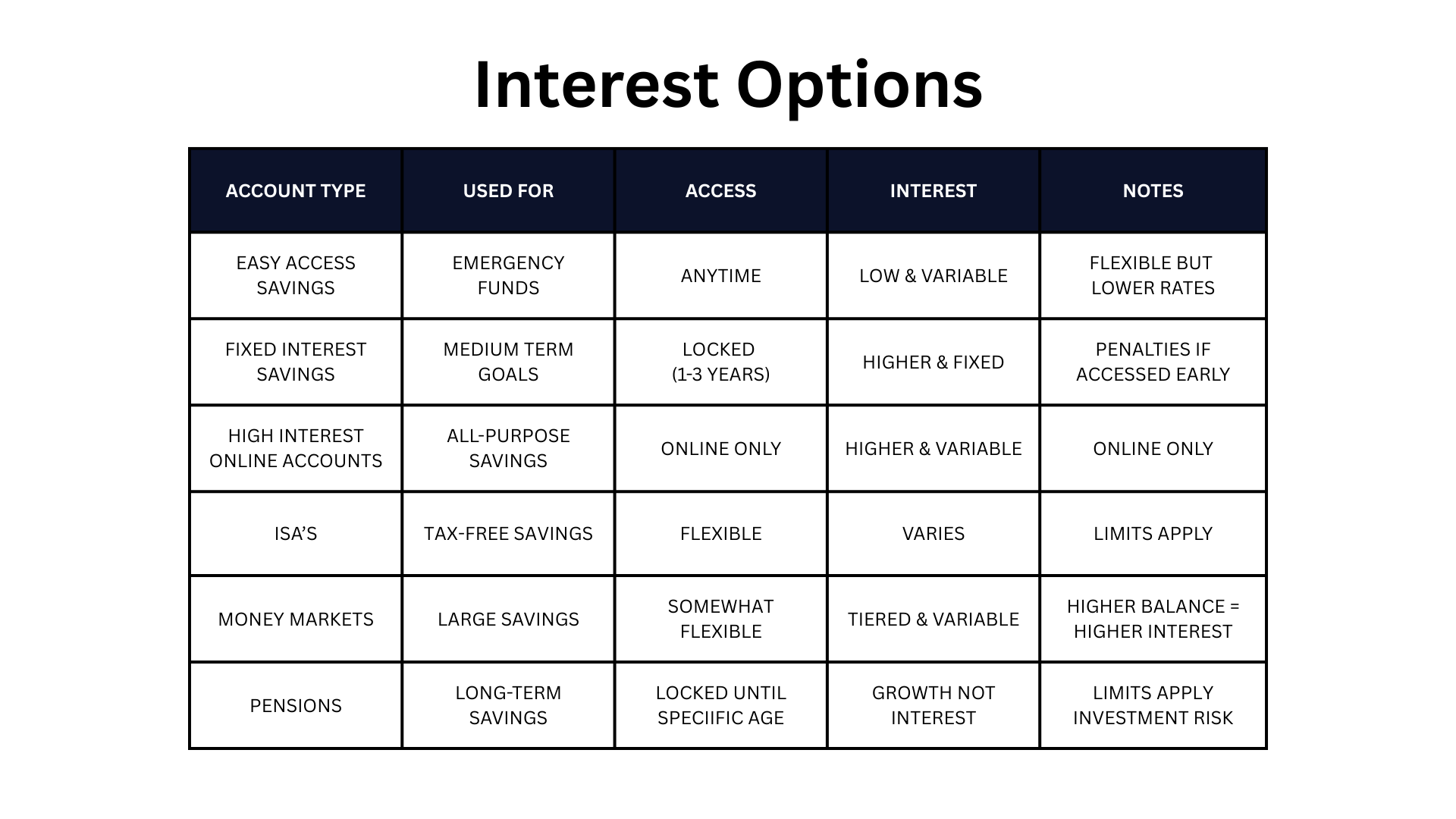

TYPES OF SAVINGS ACCOUNTS & INTEREST OPTIONS

*ISA’s can either be cash that generate interest or invested that can generate growth but capital (money) is at risk.

*Information is for educational purposes only and not to be taken as advice

finwell guide to:

SAVINGS PLANS…

watch OR listen

Watch our videos about ‘Starting Savings Plans’ and feel empowered to take action…

Win a wellbeing spa day for two!

Win a wellbeing spa day for two!

Feeling more positive?

Your feedback is really important to us!

If you’re enjoying FinWELL and already feeling more confident then tell us about your experience and you’ll be entered into our quarterly draw to win prizes including a wellbeing spa day for two!

Simply complete our short form with a bit of info about what you’ll be doing to improve your financial wellbeing.

Follow up tools & resources

-

View Group Workshops

Check out our group workshops and book onto any that might help you achieve your FinWELL challenges.

-

Book a 1-1 Guidance Session

Consider a 1-1 Financial Guidance Session with FinWELL Specialist to conquer your challenge!

-

StepChange Debt Charity

StepChange have helped thousands of people deal with debt through free guidance and advice.

-

Money Helper

Money Helper is the governments website for free and impartial guidance on all thigs money related.

-

Citizens Advice

Citizens Advice is a charity that offers free informtaion and advice on a range of matters for people in the UK.

-

Money Saving Expert

Martin Lewis is the Money Saving Expert and helps you compare and cut costs and fight your corner.